A quick update

Hello to everyone still reading Rationalising The Universe! Let me apologies for my radio silence, things have been moving around quite quickly for me so let me explain why I have been so quiet, before we go on a brief foray into the Black-Scholes. So first of all, RTU went to Rome.

Following on from that, the opportunity arose to take a qualification in investment analysis, which features a reasonable amount of mathematics and statistics. Whilst this didn’t fall directly into my recent study patterns, it presented me with a very good career opportunity and has some pretty neat applications of mathematics. As such, I have taken it – which means currently I am studying financial mathematics for the year! This site would be impossible to maintain if I wrote about anything other than the work I am doing, so as a result my writings will have a slightly more financial slant to them. They will remain applications of the beautiful language that I find fascinating.

Following on from this I had intended to write on this topic, but then RTU ended up at Glastonbury.

So that brings me to today – back ready to tap out posts a little more regularly, with a marginally different focus.

The Black-Scholes equation

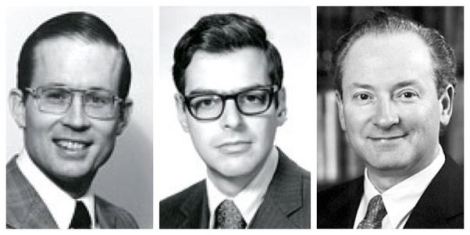

The Black-Scholes equation was developed developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s which earned them the Nobel Prize (in Economic Sciences). It is actually one of the most important piece of financial mathematics that exists, something young graduates are supposed to understand when they grilled over a shiny Canary Wharf desk.

Black, Scholes & Merton

There are many different applications of the Black-Scholes, because there are many different types of options – but for the purposes of this explanation it isn’t all that relevant. So what is an option? Well really it is as the dictionary would suggest – an option to do something. But in financial terms, it usually means an option to buy something such as a stock (but it could be anything; gold, coal, a bond, rice, coffee etc). Now the important thing about the option is you have the right to buy, but you don’t have to. Secondly, there will be a maturity – so after this date, you no longer have the option.

Option contracts are very useful – if you know you might have to buy something in the future, and you want to start to working out what it costs it may be very inconvenient if the costs are fluctuating. An option gives you the certainty of what the price could be, without tying you into a cost you may not need to incur. But what is the value to one of the option? Clearly if I can buy the item cheaper than the option price at the time I need it the option has no value; but if the option price is cheaper than I can get the item elsewhere the option has value.

The value of an option comes from two places:

- The intrinsic value: This is the difference between the market price and the option price – or in other words the amount I would gain or lose if I exercised my option right now.

- The time value: The value that comes from having the option open in the future.

This is all discursive – but how is a bank (who sells the option) going to come up with a price – not some discussion about what it should be worth, an actual price that customers can be charged. Coming up with an accurate way of pricing such options allows them to exist; if this could not be achieved no one would ever sell them.

From now on when we talk about options we are talking about stock options – the capital (money) raised by companies by issuing shares. Stock, share and equity are all interchangeable terms. The option we are considering has the following features:

- The option can only be exercised at maturity. This means that the date the option can be used is predetermined so I can’t just use it whenever I want. I might have an option to buy a share in a company on 31 August 2017 for £100.

- The stock pays no dividend over the life of the option (dividends are the division of profits amongst shareholders, which if paid during the life of the option would drastically change the valuation).

- The markets are ordinary, efficient markets (i.e. cannot be easily predicted).

- There are no transaction costs to buy the option.

The maths assumes that the returns on the underlying stock have a normal distribution (see here for further reading). The actual equation that is known as the Black-Scholes is a fairly gnarly second order partial differential equation – no body wants that.If you are familiar with partial differentials and want to know more about these terms do write to me in the comments section and I would be happy to discuss.

However for the option we have been describing (which in financial literature would be a European stock option), we can derive (which we won’t step by step) a far more useful result to price option contracts.

To make sure you are familiar with the terms, the call premium is what we are looking for – what should we charge for the pleasure of this option. This depends on all the terms on the right hand side. The current stock price, the time until the option matures and the option striking price are the most obvious ones (i.e. if I want an option at todays price for tomorrow it will probably be quite cheap, if I want it for 10 years it would be much more expensive). The risk free interest rate is a little more complicated, but can be summarised as something like a theoretical interest rate an investor would expect in the absence of all risk – the rate on a totally risk free rate. N represents the normal distribution (as a function) and e takes its normal meaning.

All of this information is taken from modelling the relationships with partial differential equations and then finding the solution. The result of this is a solution where values can be plugged in, to instantly spit out prices.

Using this information we can calculate stock option prices – here is one I plugged into a calculator earlier, where the model has told me the option I want would carry a premium of $26.30 – this is what I would need to pay the bank in order to enter into this contract. This is the pricing model that in some form is used by all the major banks.

So why is this important? Well in short it’s big money. When I discussed using the option to mitigate your risks, in reality the sexier applications come when we use the option to speculate. If you think you know the market is going to soar, say for example you think Apple are about to soar on the release of a new phone you may enter into an option to buy that stock close to todays price. You then can buy that stock when it matures, and sell it on for more on the market or (because the contracts are standardised) you can cash in and sell your option onto a third party at a higher price – because your option is now in the money. On the flip side, there is a bank somewhere that has to fulfil this option – so if they really mess up, it costs the bank a lot of money.

So the premium represents a number which is the expected amount that needs to be charged to make the contract rational to both parties. How the individuals view the value of this option however, depends on their view on the world. To me this is quite neat – the maths is strong, and when applied allows us to price up something very complex; a choice. This is however strongly based on statistical distributions – much like in quantum physics where we can only give likelihood a particle will be at a range of values, we can only give likelihood that the stock will arrive at a range of values in the future based on the current prices. What happens could make you very rich, or be a real waste of money.

Reblogged this on O LADO ESCURO DA LUA.

LikeLike

Hi RTU, nice to see half of you moving on from Black Holes to Black-Scholes. I liked your remark ‘why is this interesting? Well a lot of money is riding on it’. This is precisely the main difference between finance and physics. I am not saying that physics doesn’t have implications for profitable activities (it clearly has). But money minded people are different from entities in physics in that they adapt to and take punts on the assumptions that are modelled using Black-Scholes to obtain option prices. Isn’t that also a reason why the not- always – so- independent and random financial decision making of greedy people can cause problems for financial institutions that rely on Black-Scholes modelling?

LikeLiked by 2 people

Hello!

Revised my answer after a reread of your comment, because I missed one of the points. Indeed I am on a year of financial mathematics, which feels like quite a large contrast (although I am trying to keep as many parallels as possible). I agree with you on the main difference between finance and physics, and even though academic overlap exists (as some academics we know study!) the ability to draw large financial gain does tend to attract a variety of individuals you just wouldn’t ever find without large pay-offs.

You make a good point on greed when relying on rational models – I think this is why the ringfencing projects at the moment are so important. In theory, I don’t mind speculative finance, if the losses that can (and will) come don’t have knock-on effects to ordinary people. Clearly tax-payer bailouts and instability in retail banking arms shouldn’t happen because of someones gamble, and hopefully they won’t going forward. I think a similar failure of modelling is happening at the moment, where hedge funds are finding it very hard to make money despite quite volatile markets because the behavior of individuals (both economic and political) isn’t what a mathematical or economic model would deem to be rational. This is why Physics in many ways is more satisfying – laws in Physics generally involve entities which don’t have the luxury of choice.

Thanks for reading!

LikeLiked by 1 person

Hello Joseph!! Ummm personally I preferred when you talked about physics. Not that today’s post was bad (knowledge is knowledge), but “finance” isn’t really what I’m interested in. I would really miss the old theme. I hope that you don’t mind…

P.S I know that you have lots of comments to read, but when you get the chance would you answer my earlier question about the spacial object that added or took off an atom from earth.

Thanks

LikeLike

Hello! No problem, I understand! It unfortunately is just one of those things, to write posts takes quite a lot of time and thought so to write on the subjects you are currently having to study is a real time saver. To write about physics, while studying financial mathematics increases the workload and as you can see I have been struggling to keep up! There will be plenty of mathematics though, and a fair bit more stats which I think the blog has been lacking.

And sure, which post is it on? I honestly haven’t logged in in a while!

LikeLiked by 1 person

Thanks Joseph. In your last post “who should share information” I’ve asked a question which is this one in fact: (It’s sci-fi) Let’s say that a spacial object either a meteor or whatever, which has the power to add or substrate an atom from EVERYTHING and EVERYWHERE on earth, and flies close enough of course. Can this change the “matter” into something else completely ? Just with an atom?

LikeLike

LOL – chuckled at this Joe because we’d watched a re-run of the 2008 Kevin Stacey film ‘21’ the previous night. You may know it takes liberties with a true story of a group of maths whizzes who beat blackjack dealers in several heists. KS plays MIT math prof teaching non-linear equations who discovers one of class has ace grasp of variable statistics behind games of chance.

All the very best in your new endeavour and appreciate your intro. Suggest you may like to be aware of technical analyst Erik Hadik, whom I’ve occasionally covered in blogging on financial cycles theory (https://richards-watch.org/6-god-incidents/3-cycles/ refers, first of 3 parts intro).

From my layman’s view I think his work follows WD Gann, whose theories were based on application of biblical numerics and simple harmonic motion adjusted for ‘rippling’ effect, maybe like when tides approach max and wait to turn on a beach. So you may like to keep an eye out for his intriguing researches?

LikeLike

‘ What happens could make you very rich or be a complete waste of money ‘ made me smile it looks as if even mathematics cannot unlock the future or tell us exactly where the roulette wheel will settle. Perhaps it can point out the human folly of gambling or give us a better chance of future success. Apparently computers make a very good job of running the stock exchange after all they have no moral hangups.

LikeLike

Really enjoyed this! It’s nice to see a different style (though no less informative) of writing from you man, I enjoy your Physics content but this is refreshing! Thanks for sharing buddy, I’ll keep in contact and I look forward to your next piece, be it Physics or different.

LikeLiked by 1 person

You’re a nominated for the liebster award

LikeLike

you’ve been nominated for the Versatile award

LikeLike